Automatic Dividend Reinvestment Plans Allow Firms to

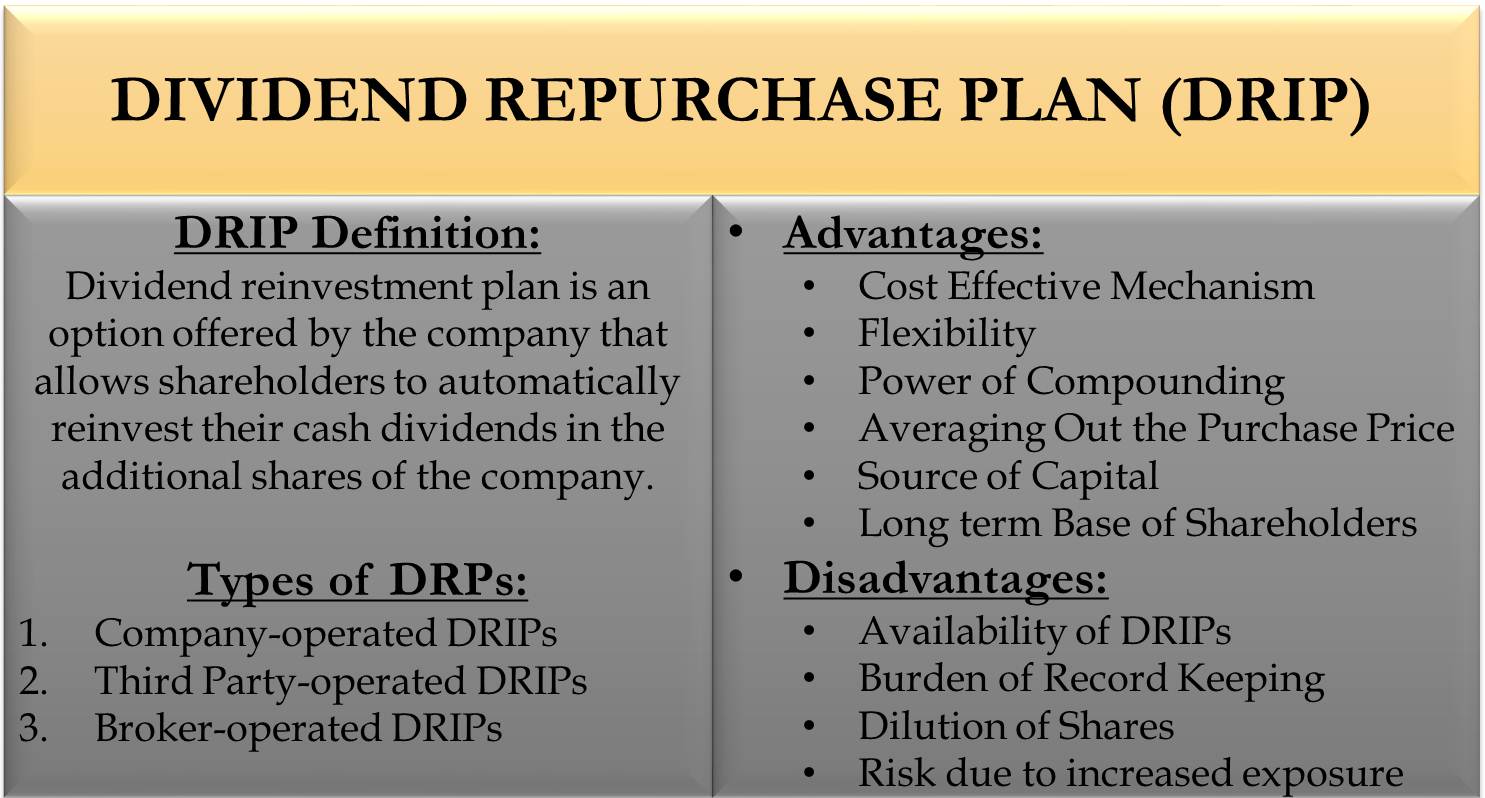

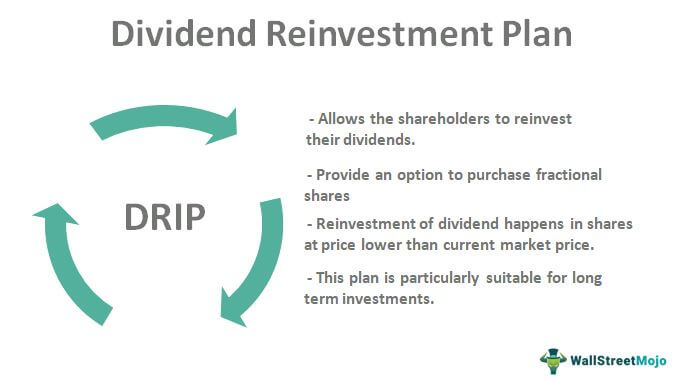

A dividend reinvestment program DRP or dividend reinvestment plan DRIP is a firms plan that allows shareholders to automatically reinvest their cash dividends in more shares of the company on the dividend payment date. These plans allow stockholders to automatically reinvest.

Dividend Reinvestment Plan Efinancemanagement

While that amount will certainly not go very far on its own it is enough to purchase around 25 more shares at the initial 10 per share price.

. These plans allow stockholders to automatically reinvest dividends in the stock of the firm paying the dividend. The majority of large companies offer dividend reinvestment plans to their stockholders. The firm experienced a participation of about 712 of the number of shares outstanding under the old plan.

Avoid the ex-dividend date reduction in stock price. Reasons for Dividend Reinvestment. However as with any other investment vehicle the individual shareholder must perform due diligence and determine whether a DRIP is a good fit with the investors.

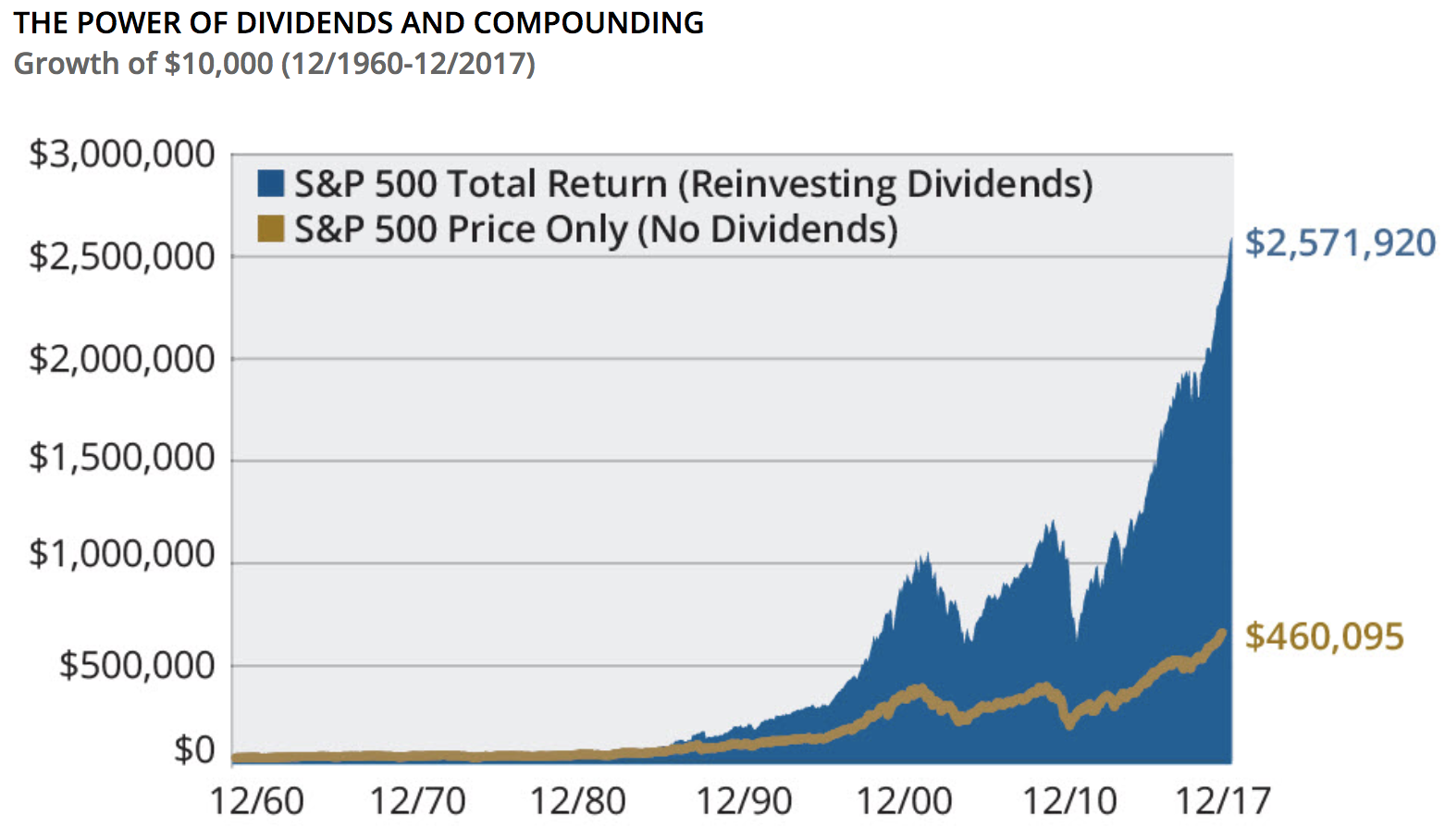

Dividend Reinvestment Plans are an effective way for long-term investors to accelerate capital growth in stock they intend to hold for a long time through an automatic and disciplined program. Automatic dividend reinvestment plans allow firms to. The compounding interest of DRIPs allows investors to purchase additional shares of stock at little or no cost simply reinvest the dividends and when enough money is accrued additional shares are.

Transform regular dividends into stock dividends D. The very first quarterly dividend check would be worth just 250. Many brokerages and companies allow DRIP investors to automatic this process making it an easy and cost-effective way to compound returns and build wealth.

Dividend Reinvestment Plan Eligible Securities The Dividend Reinvestment Plan DRIP allows you to automatically reinvest the cash dividends 1 you earn from your equity investments. The majority of large companies offer dividend reinvestment plans to their stockholders. Automatic dividend reinvestment plans allow firms to.

Instead the investors dividends are directly reinvested in the underlying equity. The word can refer to any automatic reinvestment arrangement set up through a brokerage or investment institution but it usually refers to a formal program. They have automatic dividend reinvesting which can be turned on or off.

DRPs allow for direct acquisition of shares from the company itself sometimes at a discount to the market value and involve no brokerage fees. Reduce their cash outflow to shareholders C. Dividend reinvestment plans or DRIPs DRPs in Australia and New Zealand allow investors to reinvest their cash dividends to purchase new shares in a company.

They specifically plan to use the. The investor does not receive dividends directly as cash. They need the money to cover expenses.

A dividend reinvestment plan DRIP or DRP is a plan offered by a company to shareholders that it allows them to automatically reinvest their cash dividends in additional shares of the company on the dividend payment date. This means that the shareholders automatically receive the dividend on the payment date. Given that much higher return potential investors should consider automatically reinvesting all their dividends unless.

DRIPs are dividend reinvestment plans offered by individual companies on their stocks. Pay dividends on a more frequent schedule B. Depending on which stocks you invest in you may have the option to enroll in a Dividend Reinvestment Plan or DRIP.

A dividend reinvestment program or dividend reinvestment plan DRIP is an equity investment option offered directly from the underlying company. Dividend reinvestment plans Dividend reinvestment plans DRIPs allow shareholders to reinvest their dividends in the company by purchasing additional shares instead of receiving cash dividend payments. Mutual funds ETFs and low-cost brokerages dont have DRIP s.

Dividend reinvestment plans can be classified as. This type of plan offered by about 650 companies and 500 closed-end funds allows you to automatically reinvest dividends as theyre paid out into additional shares of stock. Of course those 25 shares would then generate dividend payments of their own.

Automatic dividend reinvestment plans allow firms to reduce their cash outflow to shareholders If the total assets of a firm are unaffected by a stock dividend then. The investor must still pay tax annually on his or her dividend income whether it is received as. Dividend Reinvestment Plans.

A dividend reinvestment plan is a great way to start steadily growing your wealth and income over time. Dividend Reinvestment Plans also known as Dividend Reinvestment Programs or DRIPs are a great tool for long-term investors. However keep in mind that a DRIP is merely a tool for you to build wealth.

Dividend Reinvestment Plans DRIPs An automatic DRIP is simply a program-offered fund or brokerage firm that allows investors to have their dividends automatically used to purchase additional. Many companies offer their shareholders an automatic dividend reinvestment plan. Because of good DRIP policy and 0-commissions on almost all investment products M1 Finance is rated the Best Broker For Dividend Reinvestment Plan in 2022.

Dividend reinvestment plans are typically commission-free and offer a discount to the current share price. There are substantial cost savings to the shareholders under this plan as noted in Exhibit 1. No fees or commissions apply.

RBC Direct Investing purchases shares 2 in the same companies on your behalf on the dividend payment date. 10000 x 014. Get up to 250 for making a deposit or up to 2500 when you transfer account with 10K.

The new ADR plan allows the reinvestment of participating shareholders dividends to be used to purchase only new common stock of the firm.

Dividend Reinvestment Plan Definition Example How It Works

A Guide To Dividend Reinvestment Plans Drips Intelligent Income By Simply Safe Dividends

No comments for "Automatic Dividend Reinvestment Plans Allow Firms to"

Post a Comment